Problem

Six months ago, almost nothing in the world did not check the KYC / AML / CTF cryptocurrency, now they do almost everything, and after six months of the KYC procedure will be fully accepted and common practice in the community kriptovalyutnom. In addition, this check may be much more thorough than we can see today.

For example, one of the leading exchange platforms, Bitstamp, started using a new form of KYC asking for their customer occupation, annual revenue, net worth, financial resources and so on. D.

Security (or lack thereof) and data leakage are a matter of the KYC procedure. There is some data leakage during a very busy project token, such as Bee Token and Sentinel, where personal information is stolen. Such information can be easily used for illegal acts, including the purchase of further illegal tokens.

The problem with the passing of KYC when registering in ICO always arises from a large number of users. Documents are rejected randomly, sometimes you have to submit your data multiple times. Therefore, tens of thousands of sets of personal data must be structured and analyzed appropriately to obtain only relevant information and prevent money laundering and terrorist financing.

For each ICO and crypto exchange, it is necessary to create your own KYC to check users and prevent fraud. But this process is very expensive for its creation from the beginning.

Traceto.io aims to help solve this problem. They provide a decentralized network solution, Know Your Customer (KYC) for crypto-cash and decentralized platforms.

The essence of the project

Traceto is a decentralized digital identification system to optimize KYC procedures. Traceto’s parent company, Cynopsis Solutions, offers a KYC software product called “Artemis”, which is already used in crypto-space. They do KYC for ICON, KyberNetwork, Quantstamp, TenX, Eximchain, Refereum, Republic Protocol, Bluzelle, Gifto, Qlink, Electrify and others. Full list: https://traceto.io/clients.html

traceto.io – KYC’s digital decentralization network, which provides ownership, control and process management of the KYC community.

How will the system work?

Customers (eg ICO, Exchange, etc.) order KYC for your services and make T2T deposits for payment. Users when signing up for customer service are transferred to DAPP, which contains the correct information and is being tested. Furthermore, the identity of the service provider (Cynopsis) is verified. Artificial Intelligence (located on the C side of ynopsis, to secure storage) analyzes tasks, checks the “black list”, deviations from “norms” of data and transactions. At the same time, users are verified through the community. This work is done by real people (verifiers), who receive tokens for it. In turn, to become a member of the community, you must have a token deposit on your own wallet.Remuneration verifier depends on the amount of work performed (verification), rating (reputation) and the number of tokens stored in his wallet. Trust in employees will be achieved through the training system and its ranking (rank lowered if the decision is rejected by appeal).

Constantly receiving information from the public, there is artificial intelligence learning – improves its function algorithm. Access and control of data will be controlled by the community. With open voting, the community will decide whether to grant access to the database to a third party or not.

Data is stored in secure encrypted storage, can be decrypted only by users or clients after receiving authorization from a minimum number of verifiers. The testers themselves never have access to the encrypted user data.

Traceto Ecosystem will deploy multiple DApps to facilitate the KYC network:

User DApp – provides users with an interface to access the Traceto network. The downloading process begins when the user downloads PII and passes the identification.

DApp Service Provider – allows service providers to check KYC information and update reputation indicators. Estimates will be encrypted and placed in block space. Cynopsis Solutions will act as an initial service provider after network rollout.

Corporate Requestor DApp - provides corporate customers with an interface to pay for requests from KYC users and update them after the deadline expires. It also offers access to public key users and KYC data.

Community DApp - allows community identifiers to conduct social audits of new users.

Tokenomik

A Token (T2T) will be required by the verifier, since to receive rewards for completion of the verification task, it is necessary to have a token (a certain number) locally in their wallet. It only takes customers to pay for the job.

With certain periodicity (under certain conditions) part of the token will be “burned”. All unused tokens will be destroyed.

In total, 1 billion T2T tokens will be issued. Cost limit (Hard Cap): 35 ETH.

Token Distribution: 25% token is a command. 30% token – backup. 15% token is marketing. 40% token – sale.

Basic price: 0,0000875 ETH

Usage: 15% – backup. 50% Development. 20% – marketing. 15% – operation

Roadmap

Token Seil is scheduled for April 4 at 7:30 Moscow time on the GBX exchange . Testnet 3 + 4 quarters 2018. The service itself, maintenant should start work in early 2019 and reach full capacity by the end of 2019.

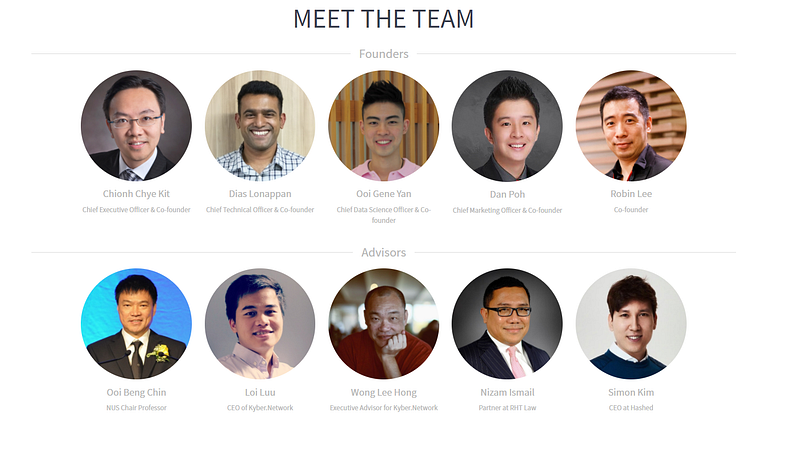

Teams and advisors

Teams and advisors

Chye Kit Chionh CEO : Working 4 years at ING (one of the largest financial conglomerates in the world), 10 years Managing Director / Head of Asian Compliance Area at Macquarie Group (financial services company with $ 481 billion under management). He is an advisor to KyberNetwork (ICO graduated on September 16th, Vitalik Buterin is on mentor, market cap is now ~ 180 million).

CTO and Co-Founder Dias Lonappan : In 2013-2017 there is CTO Quantified Assets Pte. Ltd. – private investment company, specialization: gold and crypto currency. Is the Head of Engineering of a small company (14 employees on the link) for software development for retail.

Gene-Ooi : He is the developer of iRIS, a software for KYC, used by Cynopsis. Being on the international hackaton team winner from BNP Paribas.

Co-Founder (Chief Marketing Officer) Dan Poh : The impressive work places for Sales and Compliance in Barclays, Deutsche Bank, Merrill Lynch and JPMorgan. FidentiaX adviser (small ILC since early January, now closed only 14 m) and FintruX (Izzo graduated recently, on 28 February, intermediate interest in Icodrops).

Co-Founder Robin Lee : Inzsure co-founder, is one of the founders, director of several small companies.

Advayzera:

L oi Luu – CEO of KyberNetwork, technical adviser of Republic Protocol – all successful ICOs .

Nizam Ismail – holds executive positions at Citi’s largest bank, Lehman, Morgan Stanley. Asia Electrify Advisor.

Wong lee hong - кофаундер Kyber.

Simon Kim - is CEO #Hashed (formerly Blockchain Parthners Korea) – ICON and MediBloc advisers.

Competitiveness

Traceto compared himself with the third major competitor: Civic-collected $ 33 million, the project was not uPort-ICO, Self-Key- raised $ 21.8 million, making five-khah on ICO prices.

The following comparison table is given in WP:

The fundamental difference from competitors: verification technology being met. Used together as artificial intelligence, and communities that can accomplish the task of collecting and verifying information. As for all the above projects, KYC services are provided by trusted third parties.

Get more info with link:

Official website – https://traceto.io/

Whitepaper – https://traceto.io/static/wp/traceto_io_GBX_whitepaper_v1.30_26032018.pdf

Telegram – https://t.me/tracetoio

Twitter – https://twitter.com/tracetoio

Official website – https://traceto.io/

Whitepaper – https://traceto.io/static/wp/traceto_io_GBX_whitepaper_v1.30_26032018.pdf

Telegram – https://t.me/tracetoio

Twitter – https://twitter.com/tracetoio

By Martin Vunk :

Tidak ada komentar:

Posting Komentar